Important Disclaimers

NOT FINANCIAL ADVICE: The information provided on this website and within the Crypto Futures Blueprint community is for educational and informational purposes only. It is not intended to be and does not constitute financial advice, investment advice, trading advice, or any other advice. You should not make any decision, financial or otherwise, based on any of the information presented without undertaking independent due diligence and consultation with a professional broker or financial advisor.

RISK WARNING: Trading cryptocurrencies and derivatives (futures) involves a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

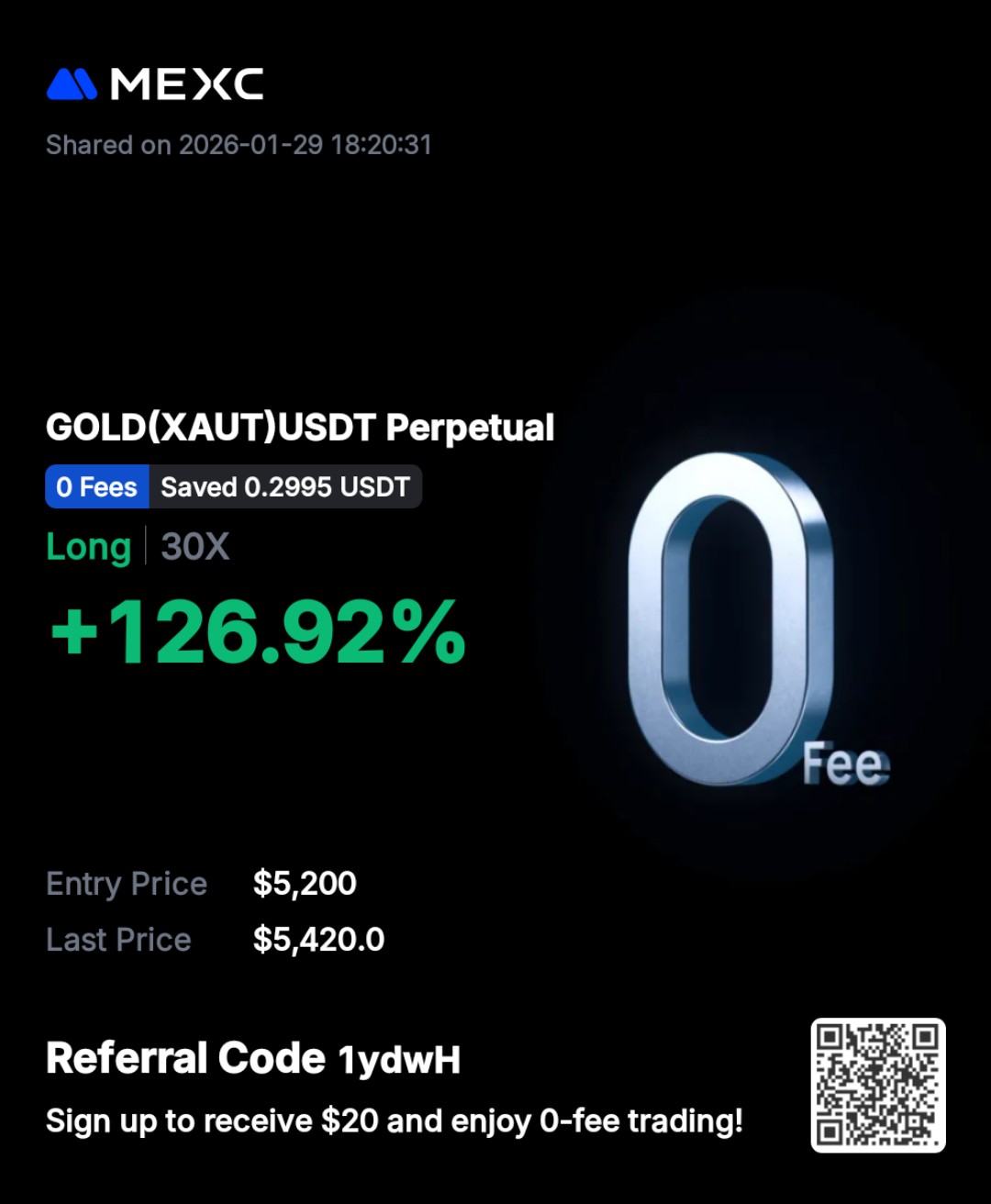

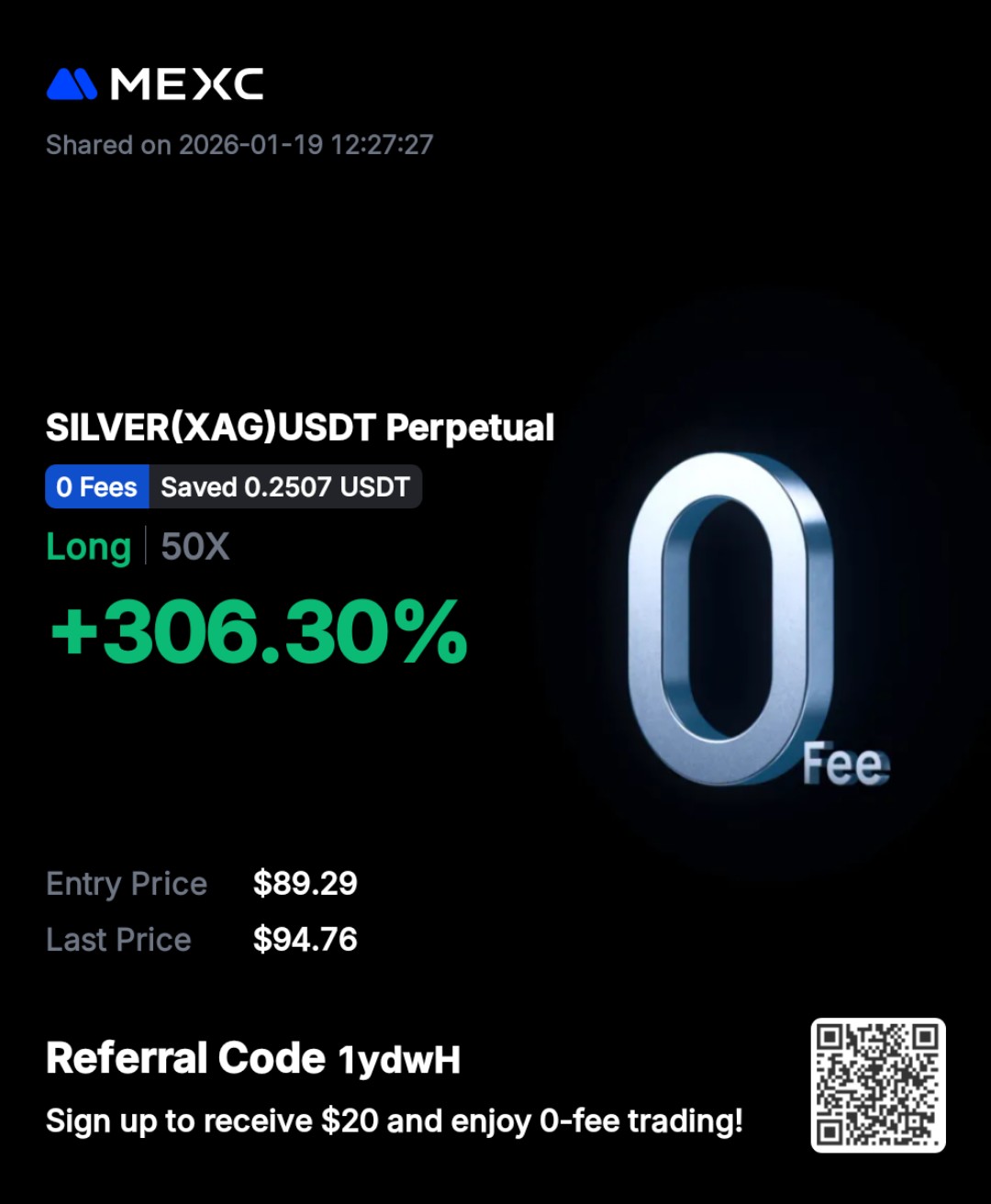

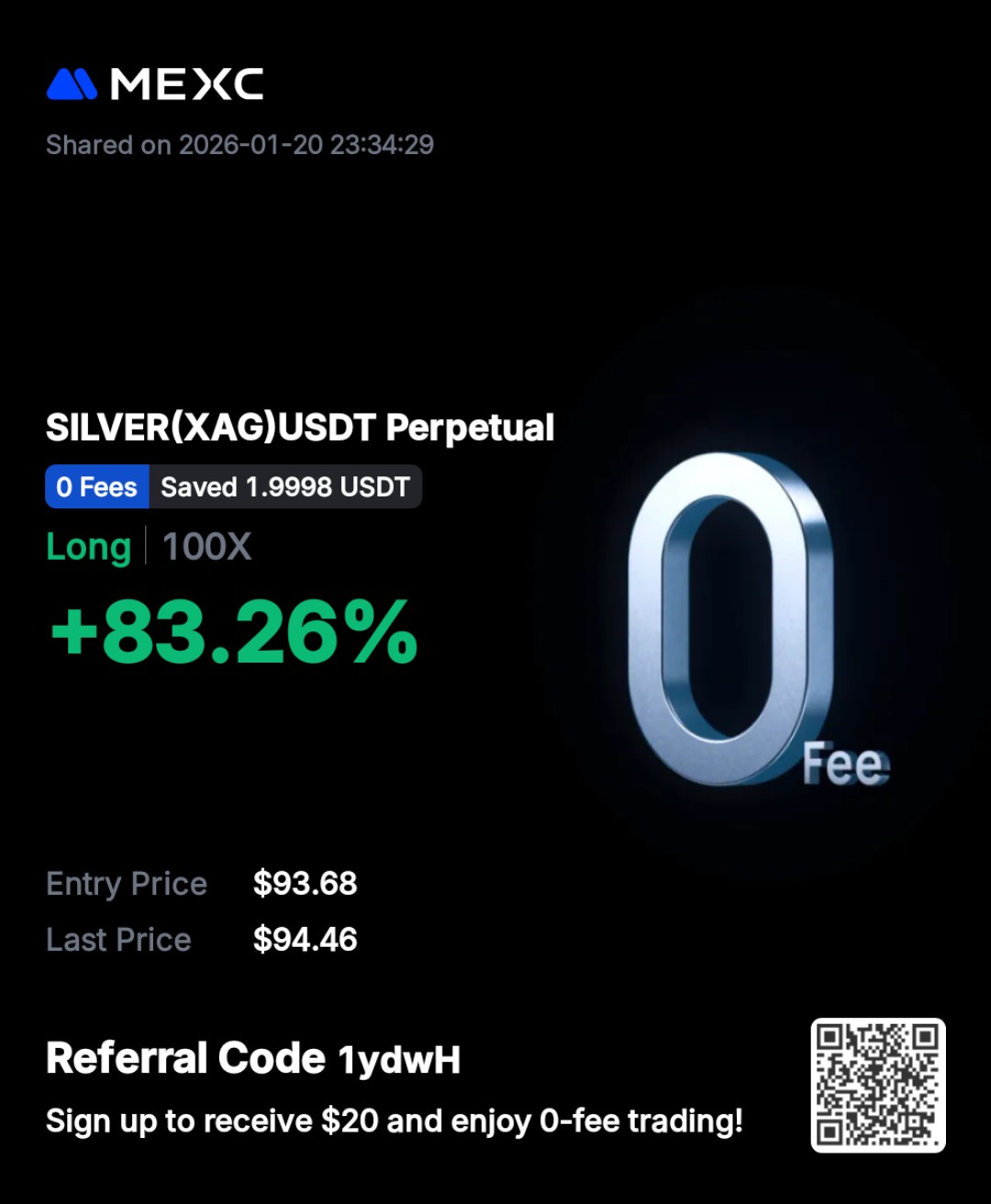

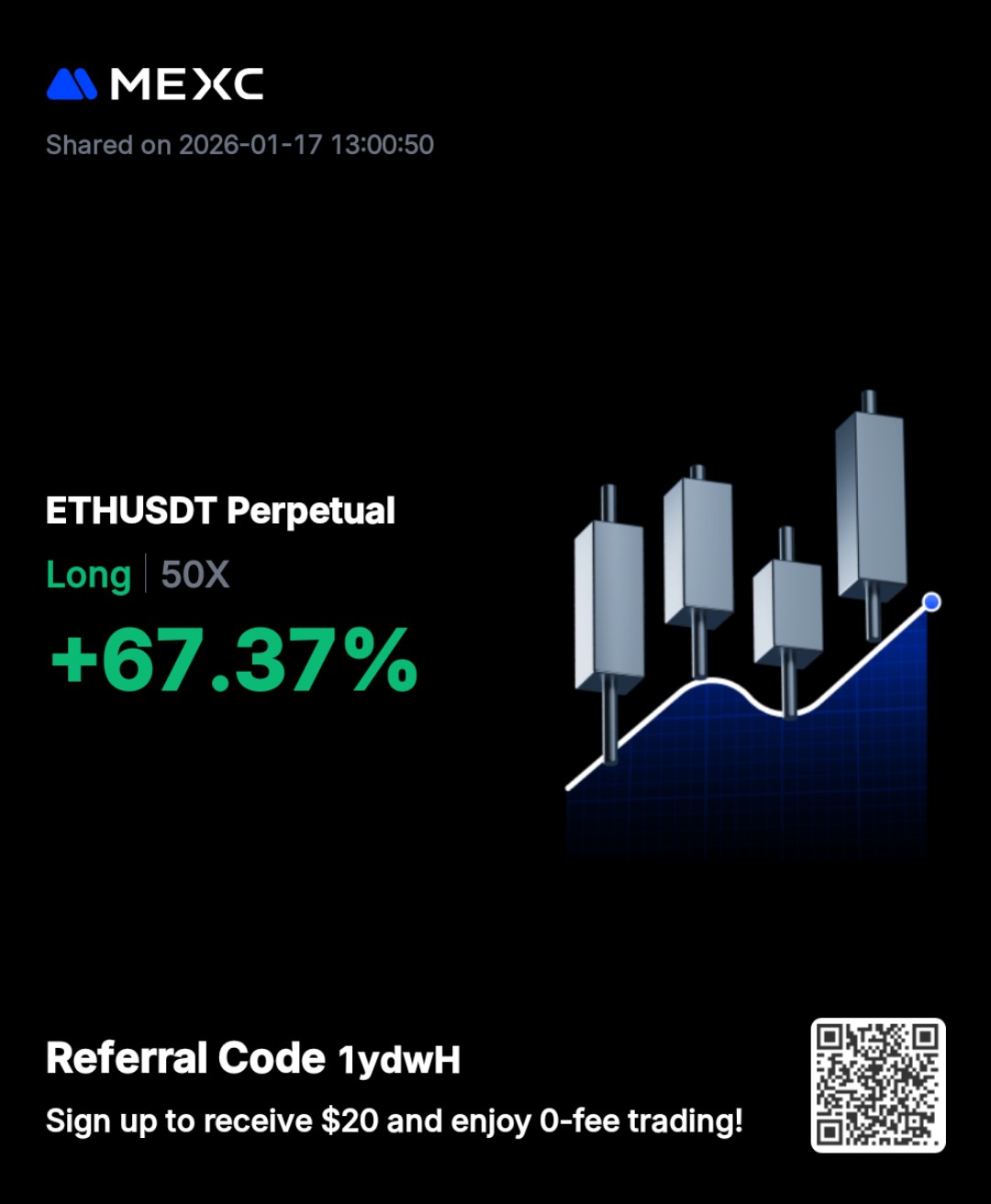

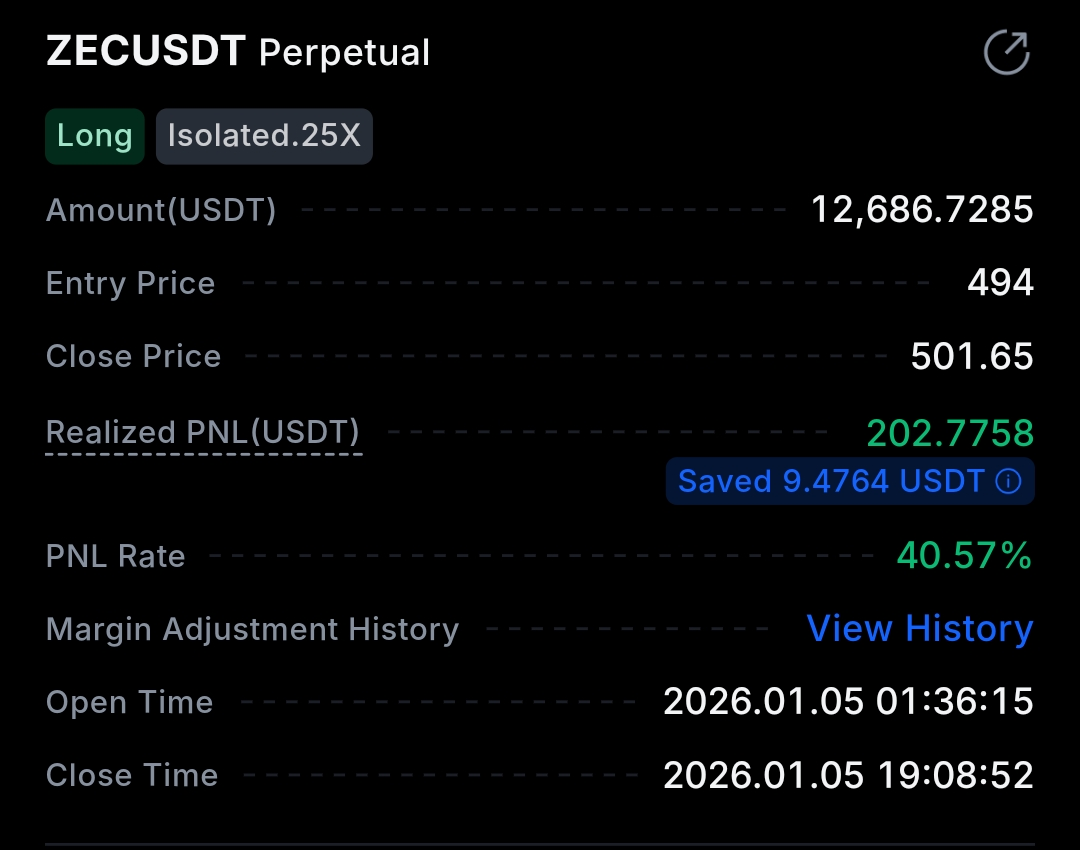

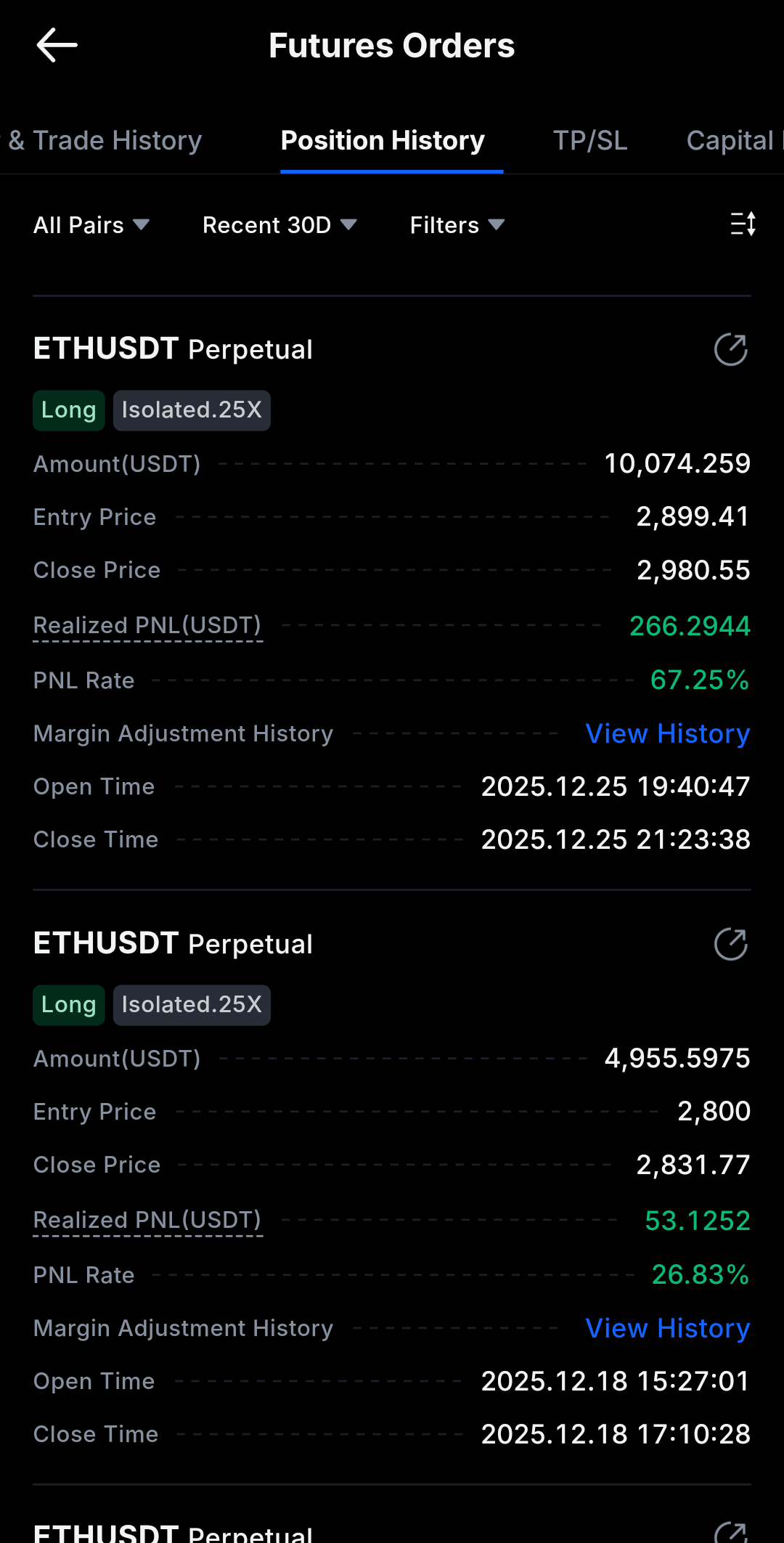

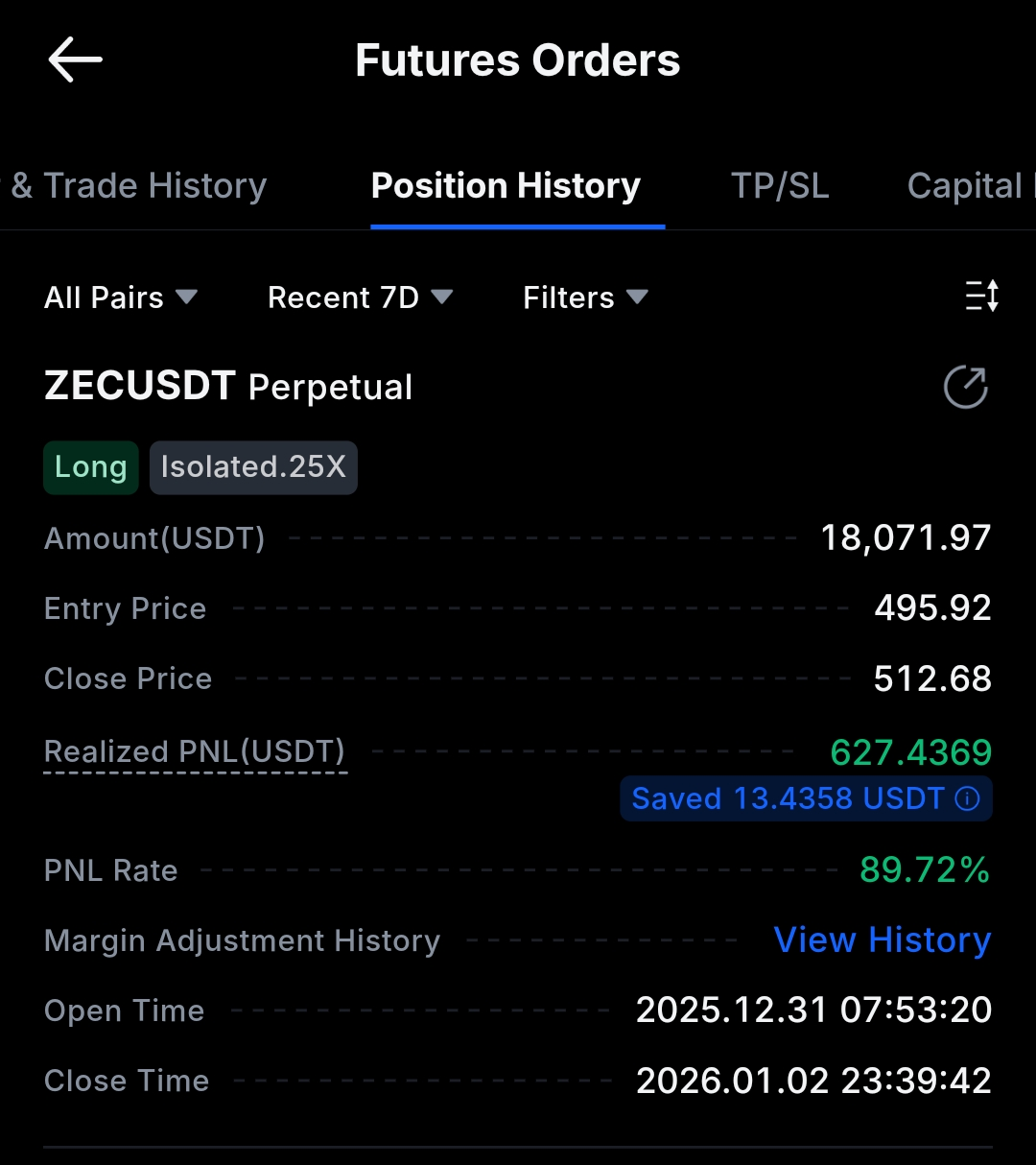

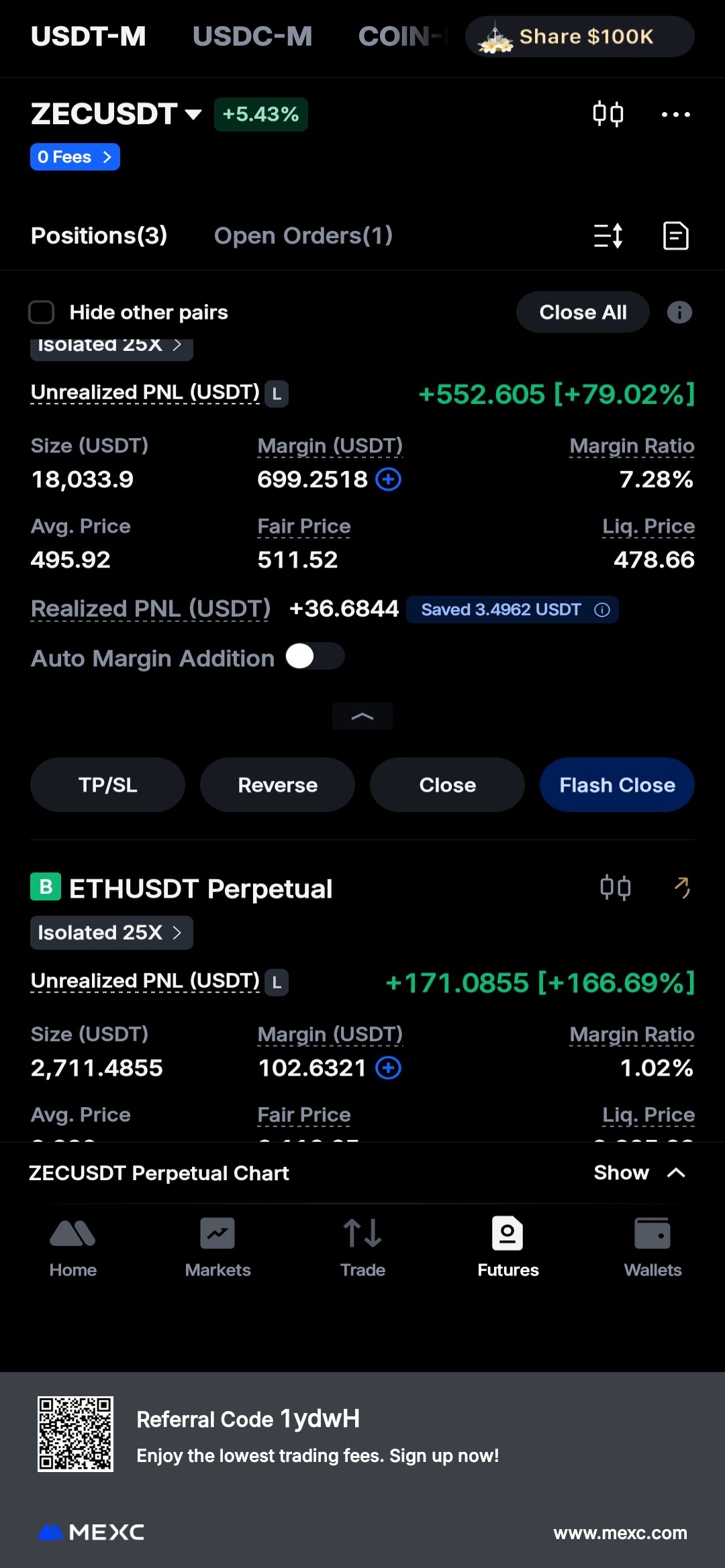

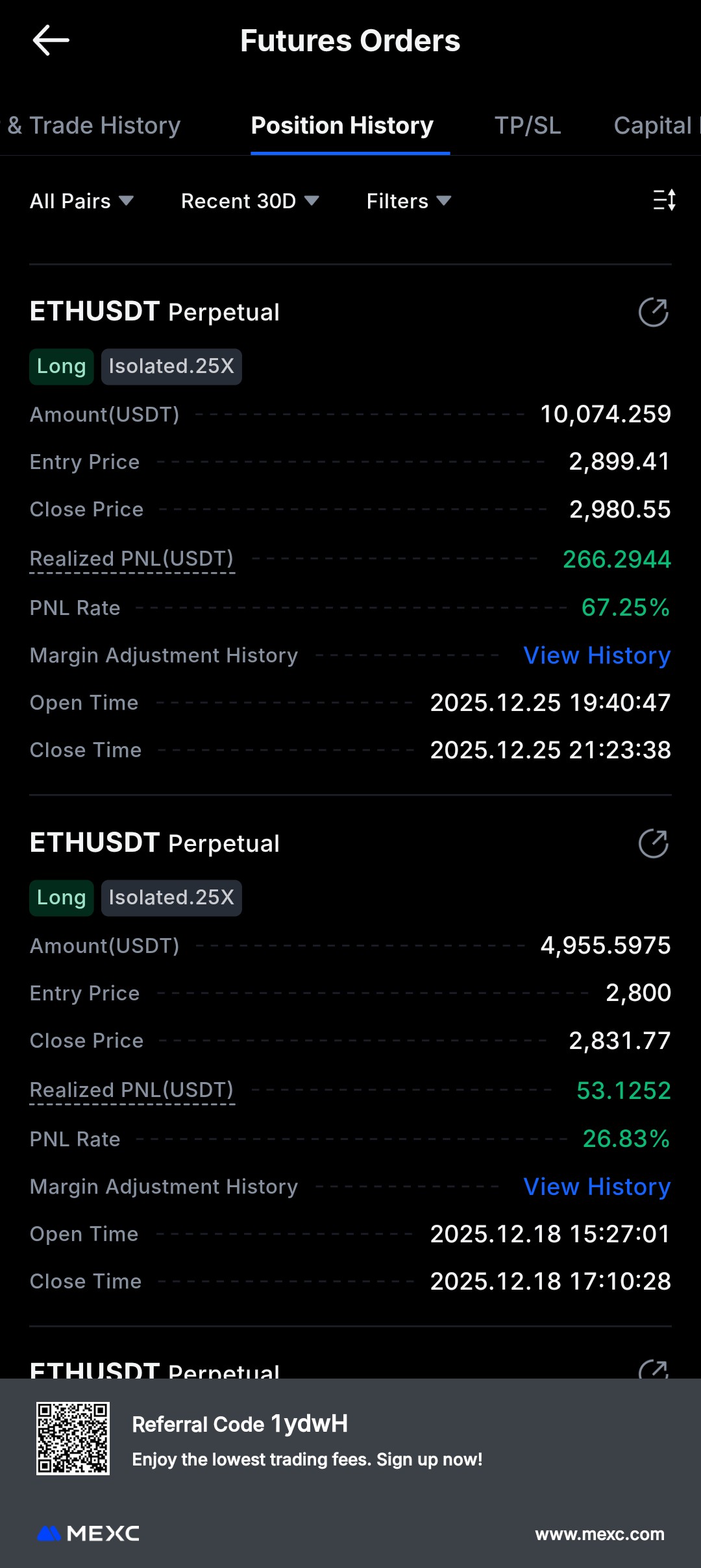

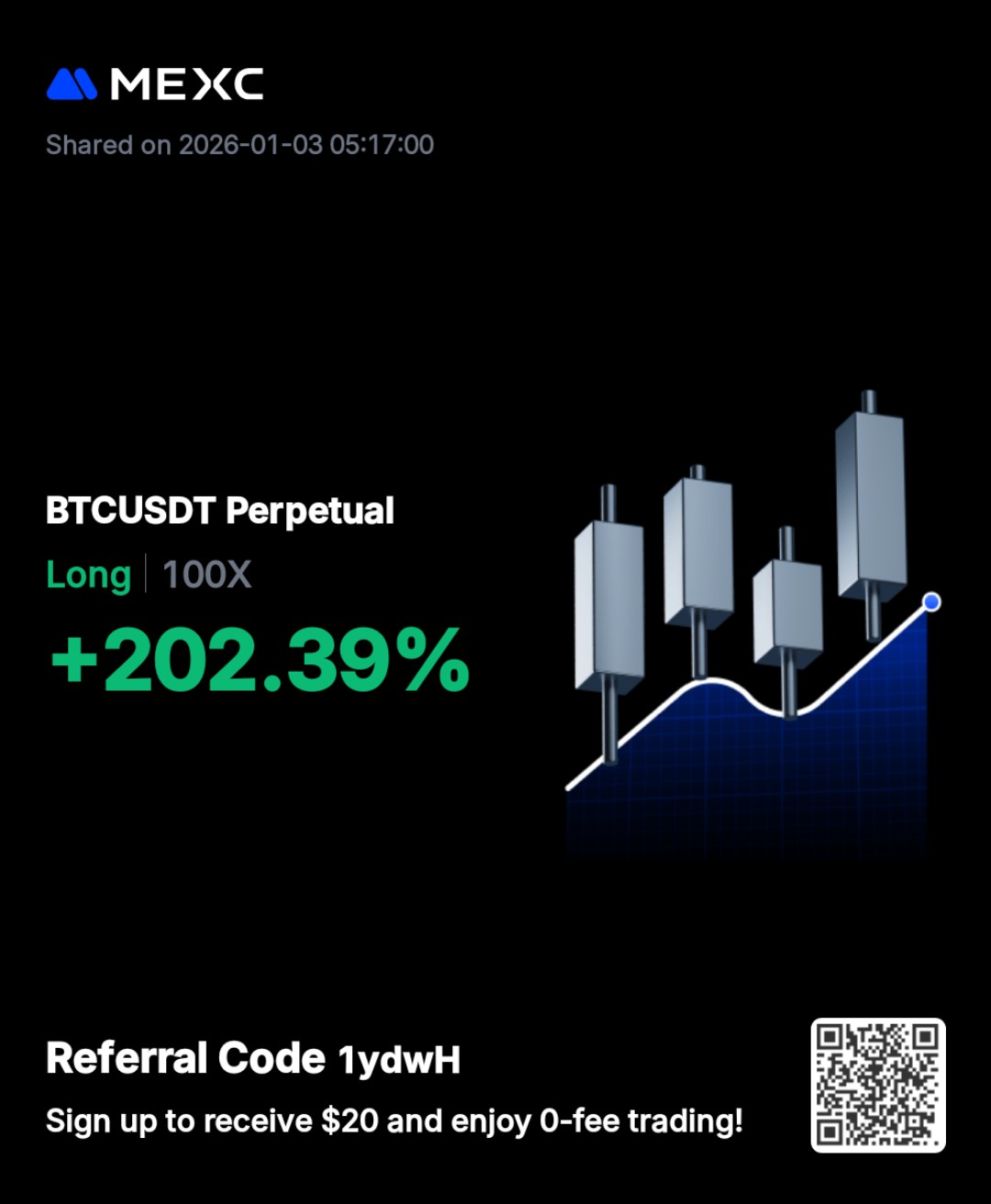

RESULTS DISCLAIMER: The trading results and PnL screenshots shown on this website are real but represent exceptional results from skilled execution. They are not a guarantee of future performance. Your results will vary and depend on many factors, including but not limited to your background, experience, and work ethic. Most traders lose money. We teach risk management to mitigate this, but we do not guarantee profits.